pressureUA

Investment Thesis

Pinterest, Inc. (NYSE:PINS) continues to impress investors positively, demonstrating that it can still deliver reasonable growth rates.

More specifically, as we approach H2 2024, Pinterest continues to put forth a strong narrative backed by solid fundamentals.

All in all, I believe that paying approximately 40x EBITDA for PINS makes sense, given that there’s still room for further margin expansion in the back half of 2024.

I make the case that in the next twelve months, we’ll look back to PINS at $44 per share and consider it a bargain entry point.

Rapid Recap

Back in January, I argued in a bullish piece,

Given the recent uptick in its share price, I’m inclined to believe that at long last investors have started to become interested in this stock that I’ve been recommending for a while.

The stock is priced at 40x EBITDA. Even though I remain bullish on the stock, I’m also able to remark that this investment is not blemish-free. Also, what’s particularly bullish about Pinterest is that it has no debt on its balance sheet and more than $2 billion of cash and equivalents.

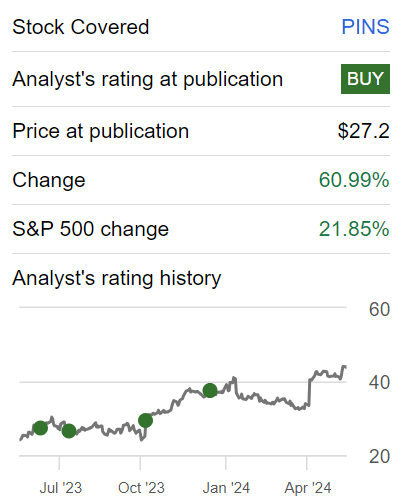

Author’s work on PINS

As you can see above, PINS is a stock that I’ve been bullish on for a while, with the stock up 61% versus the S&P 500 (SP500) which is up 22% in the same time frame. And now, as I look ahead, I continue to assert that there’s still more upside to come.

Why Pinterest? Why Now?

Pinterest enables users to discover and organize ideas through visual content such as images and videos. It focuses on user curation, allowing individuals to create boards that reflect their personal interests and inspirations.

What makes Pinterest unique is that it emphasizes a positive user experience and personalization, distinguishing itself from traditional social media by fostering a space for creative exploration.

Moving on, Pinterest’s near-term prospects are exciting as its user base has surpassed 518 million monthly active users, marking consistent growth for seven consecutive quarters.

This momentum is bolstered by Pinterest’s investment in AI to enhance personalization and relevance, transitioning from CPU to GPU serving to handle more complex models. These AI advancements have significantly improved content recommendations, leading to deeper user engagement and satisfaction. Furthermore, Pinterest has reinvigorated its core features, such as curation through boards and collages, and enhanced shopping capabilities, making the platform more actionable and user-friendly.

In sum, under this CEO, Pinterest appears to have strategic clarity and execution.

That being said, as the platform continues to shift into a higher gear, uncertainties arise from the phased deprecation of third-party cookies on Chrome, which impacts targeting capabilities. More specifically, Pinterest must continue to invest in key areas such sales organization expansion and technical selling capabilities to sustain its growth. Because for this investment thesis to work out favorably, Pinterest has to convincingly prove that there’s still significant growth left in the business.

Given this balanced background, let’s now discuss its fundamentals.

Pinterest Could Deliver High Teens Growth

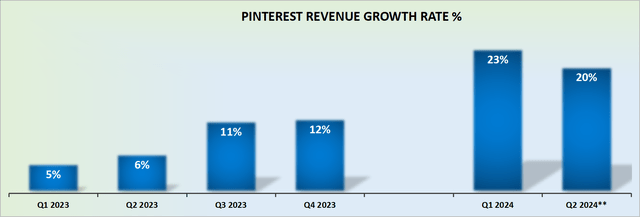

PINS revenue growth rates

In my previous analysis back in January, I said,

[…] let’s keep in mind that H1 2024 is up against very easy comparables. This means that unless something goes dramatically wrong, a strong H1 2024 is practically in the bag.

But can Pinterest sustain mid-10s% beyond H1 2024?

We are now practically halfway through 2024. And we know that Pinterest guides for about 20% top-line growth for Q2 2024. This implies that there may be some further upside potential for Q2 2024 given that management would seek to be conservative with its guidance.

Consequently, despite the passage of time since my previous analysis, I still remain relatively uncertain of whether we can count on Pinterest for more than mid-teens growth rates for H2 2024.

That being said, even if Pinterest ends up growing in the ballpark of 15% to 18% CAGR over the next twelve months, this is nothing to be dismissive over.

Recall, it wasn’t many quarters ago when Pinterest was delivering sub-10% revenue growth rates and many investors had presumed that the social media platform was left for dead.

With that in mind, let’s now discuss its valuation.

PINS Stock Valuation — 40x This Year’s EBITDA

In my previous analysis, I said,

As I look ahead to 2024, I estimate that Pinterest will see around $640 million of EBITDA. For this figure, I estimate, Pinterest’s progress on its EBITDA margins sustains at approximately 20% for 2024.

And this is where things become complicated.

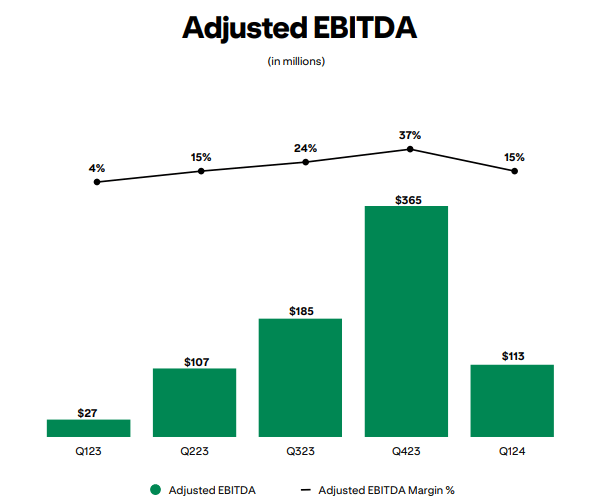

PINS presentation

Pinterest declares that its adjusted EBITDA margins expansion in H2 2024 will not be as strong as we are expecting for H1 2024.

Here’s an excerpt from the earnings call to support that contention.

[…] we expect significantly more margin expansion to occur in the first half versus a more modest level in the second half, as we lap the strengthening adjusted EBITDA margins we drove in the second half of 2023.

Now, here’s some nuance. Keep in mind that Q1 2024 saw its EBITDA margins expand by 1,080 basis points y/y. Even if Pinterest delivers half of that whopping expansion, or any expansion at all for that matter, this would further support my thesis that Pinterest could deliver at least 20% EBITDA margins.

Altogether, I believe that there’s the possibility for Pinterest to deliver $750 million of EBITDA this year. This leaves PINS priced at 40x EBITDA, a multiple that I consider reasonable, provided that PINS can convincingly continue to grow at close to 15% to 18% CAGR.

Moreover, keep in mind that Pinterest holds approximately $2.7 billion of cash and marketable securities and no debt. Clearly, this provides Pinterest with significant options, including the ability to make some bold needle-moving acquisitions.

The Bottom Line

Investing in PINS at approximately 40x EBITDA remains a compelling proposition, despite certain uncertainties.

The company has demonstrated consistent growth momentum. Pinterest’s emphasis on AI advancements to enhance personalization and relevance, coupled with strategic investments in core features and shopping capabilities, indicates a positive trajectory for the platform’s future.

It has strong fundamentals, including its debt-free balance sheet with over $2 billion in cash and marketable securities, providing a solid foundation for continued growth. Therefore, considering the potential for sustained mid-teens growth rates and reasonable valuation multiples, investing in Pinterest at this stage could a rewarding risk-reward.

from Finance – My Blog https://ift.tt/1qkUb2O

via IFTTT

0 Comments