mphillips007

Investment Thesis

I believe that, at its current price, D.R. Horton Inc. (NYSE:DHI) is a hold. The continued growth in across the top and bottom line, along with its strong market positions in key U.S. housing markets, makes me believe the company will continue to succeed. Add to that a balance sheet where the company’s assets far outweigh its liabilities, and it’s not hard to see why this stock often trades at a premium. With that in mind, a discounted cash flow DCF analysis shows that the expected returns for DHI would likely not beat the S&P 500 and therefore means it’s a hold for me for now.

Introduction

As an investor trying to choose stocks that will outperform the market, my approach is to choose companies I can understand which have a clear and sustainable advantage over their competitors. This is because, I think, this will allow management to better reinvest back into the business, compounding the returns to shareholders over time, which should be to my benefit.

Generally, I find myself investing in dividend stocks thanks to the stability and growth they offer. It matches my investment style by providing a source of passive income whilst still compounding returns and lowering overall risk.

A company that I, along with many other dividend investors, have been watching is D.R. Horton thanks largely to the impressive dividend growth rate it has seen over the past several years.

Company Profile

D.R. Horton, Inc. is headquartered in Arlington, Texas and is the largest home builder in the U.S. by volume, which they have been since 2002. First started in 1978, the company operates in 119 markets within 33 states where they build a variety of homes, including single-family detached homes, which make up the majority of its sales. Homes in the D.R. Horton generally range from $200,000 to $1 million, attracting a range of purchasers from first-time buyers to luxury buyers. Additionally, the company provides mortgage financing and title services to homebuyers through its financial services subsidiaries.

D.R. Horton’s Market Presence (D.R. Horton)

Thanks to its strong financial performance in the last 10 years, the company has seen its stock price rise substantially, outperforming the market. As a result, DHI shareholders have seen a CAGR of 20% in the stock price since 2014 and is another factor drawing me in to take a deeper look into the company.

Dividend Discussion

Dividends are a way of assessing a company’s financial health in my opinion, and as someone keen on having financial freedom through sustainable dividend investing, I pay close attention to them. When I’m diving into a company’s dividend, I look at the company’s dividend paying track record, this tells me whether the company is likely to maintain or raise a dividend through all economic conditions and helps me establish my expectations.

Over the last twelve months, D.R. Horton’s dividend is $1.10, yielding about 0.86% at a share price of $140.32 which is below the S&P 500 average of 1.35% and has a payout ratio of approximately 7.5%, which in my opinion is very sustainable. When compared to competitors like Lennar Corporation (LEN) and Toll Brothers (TOL), DHI’s dividend yield is lower, with LEN and TOL offering 1.3% and 0.8% dividend yields respectively, all the while the payout ratio of D.R. Horton is higher than the competitors I just mentioned. This suggests to me that the dividends of Lennar and Toll Brothers are slightly stronger than that of D.R. Horton. That being said, I believe that the most compelling reason for a potential investment into DHI isn’t because of its dividend but instead because of its impressive financial standing, business model and industry tailwinds.

Financial Discussion

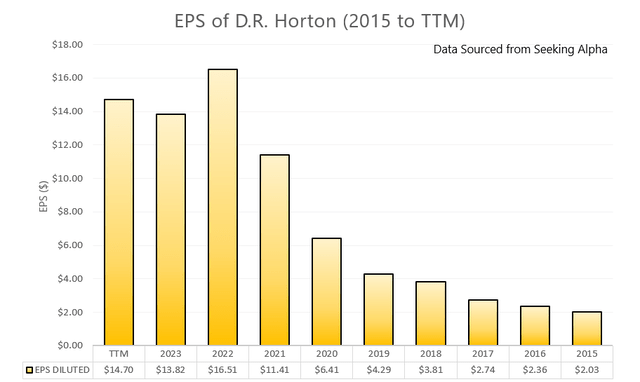

D.R. Horton has grown considerably over the last decade, thanks in part to strong top-line growth. Revenue during this period grew from $10.82 billion in 2015 to $37.06 billion in the TTM, approximately a 14.7% CAGR. Thanks to the strong revenue growth, key profitability indicators, specifically the Earnings Per Share EPS, have also seen sharp increases. EPS has seen even more impressive growth than revenue, in 2015 EPS was $2.03 compared to the TTM where it is $14.70, a great CAGR of 24.6%. This excellent growth is despite the fact TTM EPS is down from its 2022 highs, which were before rate rises began impacting the business.

D.R. Horton’s EPS summarized (Division One Dividend)

Turning to the balance sheet, I believe that the company is in a pretty good position, with a healthy amount of assets relative to debts and other liabilities. As it stands, the company has a total debt of $5.98 billion, compared to a cash and cash equivalents position of $2.75 billion. The solid cash position in combination with D.R. Horton’s free cash flow of $2.22 billion gives me confidence that the company can comfortably pay off all its debts. Additionally, the current ratio and debt to equity ratio stand at a very healthy 5.7 and 0.42 respectively, giving me further confidence that the company is in a stable financial position.

Looking to the most recent quarterly earnings released in April for DHI, the company saw a 14% rise in consolidated revenue in the quarter compared to the previous year, whilst net income increased 24% to 1.2 billion or $3.52 per share. What is encouraging for me is that most major segments of the company appear to be growing well, for example, the home building segment continued to show strength, with 22,548 homes closed for the quarter, up 15% compared to the year prior, whilst Forestar sold 3,289 lots in the quarter compared to 2,979 lots in Q2 last year. On the dividend front, another quarterly dividend of $0.30 was declared and then paid in May.

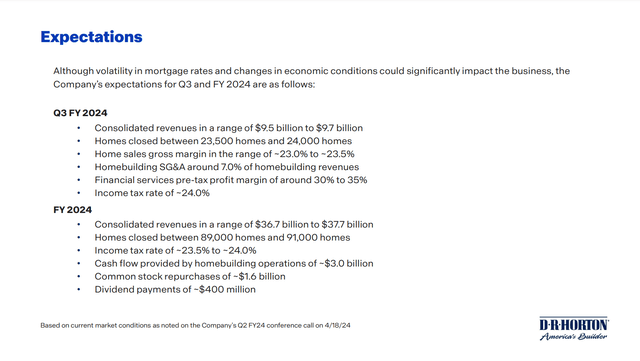

Additionally, management also updated guidance for fiscal 2024. The company expects consolidated revenues of between $36.7 billion to $37.7 billion and homes closed by homebuilding operations of 89,000 homes to 91,000 homes, which is an upward revision compared to their previous guidance but still corresponds to slower growth relative to what they have experienced in the past. I expect D.R. Horton to deliver numbers within their guidance range over the coming quarters and anticipate that, should we see rate cuts later in the year, the company will start to forecast stronger growth beyond 2024. However, to me, it’s clear that no one is certain when rate cuts will arrive.

D.R. Horton’s earnings guidance (D.R. Horton)

An Eventual Return to More Affordable Markets Should Fuel Further Growth

To me, the house building sector appears to be in a unique position. On the one hand, you have home affordability, which continues to trend higher and is making owning a house unattainable for many Americans, whilst on the other hand, we continue to see strong demand thanks to the notable demographic trends and a shortage of housing. I believe we may be approaching an inflection point where we will see a reversal of one or more of these trends, which I think will have a notable impact on DHI.

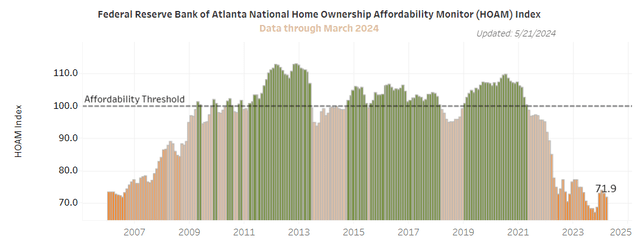

To start with, the Home Ownership Affordability Monitor suggests that home affordability is presently at levels not seen since the GFC, with the annual total payment for a house comprising 41.7% of the median income, which is far above the typical affordable threshold of 30%. To me, this is unsustainable, and I believe leaves many Americans in a difficult position where they may be at risk of missing payments unless things change soon, either by increasing housing supply or reducing interest rates.

Home Ownership Affordability Monitor (Federal Reserve Bank of Atlanta)

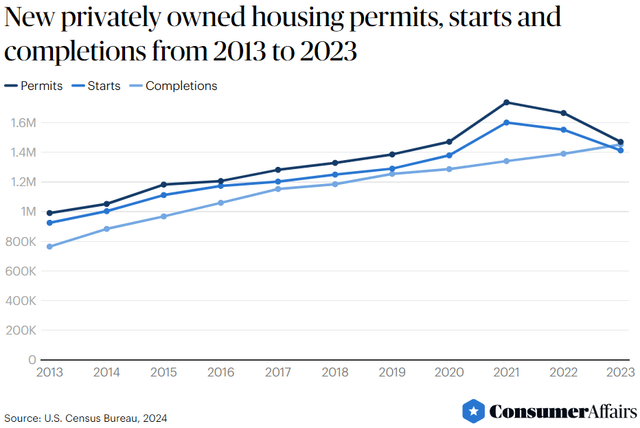

In my opinion, outside of us reaching a point where mass defaults occur like during the GFC, an event which I believe is somewhat unlikely, my long-term outlook for the business is relatively strong. While there remains uncertainty around when rate cuts occur, I believe we will see cuts by the end of the year, which should encourage individuals and businesses to borrow in order to fund construction projects, potentially reversing the trend of lower home construction we have seen in the past 2 years.

New Housebuilding Projects (Consumer Affairs)

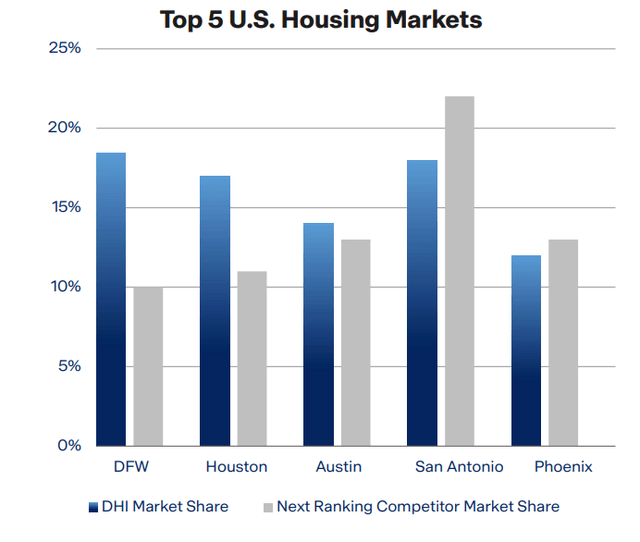

Additionally, DHI is the leading home builder in 3 of the top 5 U.S. housing markets as well as many other growing markets and, in my opinion, is a very well-run business which I believe will contribute to the company growing at a faster rate than many of the broader industry. Essentially, this is to highlight that D.R. Horton is in a very good position to capitalize if, and when rate drop, and the amount of new home building projects return to growth again. And, if I am wrong, and we do see a notable rise in defaults among homeowners, impacting industry demand, the company is in a strong position financially to weather an economic downturn, likely better than many of its competitors.

D.R. Horton’s Market Position in Top 5 U.S. Housing Markets (D.R. Horton)

Valuation

D.R. Horton’s previous decade of growth has been impressive in my opinion and suggests that the business has successfully positioned itself as a market leader within some of the top U.S. homebuilding markets despite the obvious headwinds the industry is presently facing. To me, it’s clear that D.R. Horton is a high-quality business, however, for me, that is not enough to warrant an investment, valuation matters. Seeking Alpha Quant currently assigns DHI a valuation grade of C- suggesting the company is around its fair value if not slightly overvalued. The current PE ratio also suggests the DHI is slightly overvalued, being that it is above its 5-year average. This sentiment isn’t shared by Wall Street, which has assigned a buy rating for the stock.

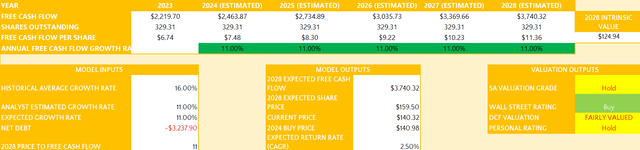

For me to better estimate D.R. Horton’s valuation, I have decided to use a DCF analysis. DHI’s free cash flow (“FCF”) for the last twelve months was reported at $2.22 billion. Assuming they grow at 11% over the next 5 years, which is less than historical growth rates and in-line with estimates, D.R. Horton’s FCF is estimated to be $3.74 billion by 2028. I believe this growth projection, seems reasonable given DHI’s strong market position, particularly within key markets with demographic trends favourable to D.R. Horton’s business model.

Based on the estimated growth rate and a price to FCF of 11 in 2028, the expected price of DHI is $159.50. This suggests that a CAGR of only 2.5% is possible for investors if buying at today’s share price. Based on the expected return from the DCF model and considering the outlook of the business and the potential risks, I believe that at the current price of $140.32, DHI is a hold.

D.R. Horton’s Valuation (Division One Dividend)

Takeaway

Despite the recent trends within the housing sector and the uncertainty surrounding interest rates and economic outlooks, D.R. Horton has shown strength and continued to grow key financials, demonstrating their great business model. My outlook for the business is mostly positive, the company maintains a strong position in many key U.S. housing markets and has excellent financials to support them through any environment, whether we see continued strong demand or experience somewhat of a downturn. The issue for me when considering an investment into DHI is that, unfortunately, everyone knows it’s a good business and so it is priced accordingly. As a result, based on the DCF model, I do not expect to receive market beating returns from the stock and therefore class it as a hold for now.

from Finance – My Blog https://ift.tt/ml7OeV1

via IFTTT

0 Comments